Tax Business Software Solutions for Professional Tax Preparers

5 min read

By using QuickBooks Payroll, all your wages, salaries, and payroll taxes will be included automatically in your financial statements. After this lesson, you’ll be able to set up employees in QuickBooks, enter and run payroll, pay employees by direct deposit or check, and reconcile your payroll taxes. Today’s leading accounting platforms offer standard security features like data encryption, secure credential tokenization and more.

Is QuickBooks Online Accountant for You?

There is no need to download QuickBooks Online because it is connected to the cloud, which means you can access online accounting from any device with an internet connection. You can download the QuickBooks Online mobile app from the Google Play Store or Apple App Store. QuickBooks Online mobile access is included with your QuickBooks Online subscription at no additional cost. Accountants have complete access to a company’s books when using QuickBooks Online Accountant. They can run trial balances, export data for taxes, void or delete transactions and reclassify transactions in bulk to save time.

- Requires connection to client’s financial institution and credit card accounts.

- Once they’ve applied for Payments and have been approved, they can begin accepting payments and the accountant can start earning revenue share for their transactions.

- Intuit reserves the right to limit each telephone contact to one hour and to one incident.

- As a small business owner or manager, you know that managing expenses is as important as generating sales.

- Multi-factor authentication is required, and the company safeguards your data using AES-256 (Advanced Encryption Standard with 256-bit keys), which ensures the highest level of cryptographic security.

QuickBooks Online

This includes adjusting entries and mapping account balances to specific tax lines. The QuickBooks ProAdvisor program offers benefits and resources that get better as your firm grows. If you don’t need accounting just yet, our new money solution offers banking, payments, and 5.00% APY—all with no subscription or starting fees.

- A subscription includes a portal to your clients’ books and QuickBooks Online Advanced, which you can use for your firm’s books.

- Revenue share payouts are determined by the net revenue share from the transactions the clients’ process in QuickBooks Payments.

- It also allows them to jump to management reports and a chart of accounts to get a higher-level look at the accounts.

- Small businesses that are growing may want to use QuickBooks Essentials.

- For an extra $50, sign up for a one-time live Bookkeeping setup with any of its plans.

From day-to-day bookkeeping to year-end prep. Do it all in QuickBooks Online Accountant.

- This plan gives you all the basics needed to run your business accounting, including income and expense monitoring, invoice and payment capability, tax deductions, receipt capture and mileage tracking.

- You can consolidate notes in the dashboard so that everything you need is in one convenient spot for your clients.

- The other page shows the more typical dashboard tools and data, like graphs for income and expense status, profitability, sales totals, and account balances.

- A key added feature of the QuickBooks Essentials plan is the ability to manage unpaid bills and allocate billable time and expenses to a specific customer.

- If you upgrade to Premium or Elite, you’ll get access to HR tools, such as onboarding checklists and performance tools.

The software was popular among small business owners who had no formal accounting training. As such, the software soon claimed up to 85 percent of the US small business accounting software market. QuickBooks Online is cloud-based accounting software that covers all the accounting needs you may have. It’s a subscription-based service that is good for various industries and beneficial to those who regularly work with a bookkeeper or accountant because you can give them access to your files. Read our comprehensive QuickBooks Online review to decide if this popular accounting software is the best choice for your needs and budget. At $90 per month for QuickBooks Online Plus, you need to be committed to using it conscientiously and comprehensively.

There are over 200 options instead of the 650-plus to its cloud counterpart. When signing up for QuickBooks Online, it only gives options for paying monthly. However, once you’ve signed up, navigate to your account settings, and you can switch to annual billing to save 10%. All Online plans include receipt capture, QuickBooks support and more than 650 app integrations with apps such as PayPal, Square and Shopify. When working with the Desktop version, it’s downloaded right to your computer.

There are 55 guides in our QuickBooks Online tutorial, spanning eight main modules. You should plan at least two hours to complete the first module, which includes 14 video tutorials. File T1s, T2s, and T3s for all your clients from within QuickBooks Online Accountant. Sign up for Lab Report to get the latest reviews and top product advice delivered right to your inbox. Find help articles, video tutorials, and connect with other businesses in our online community. Here’s everything you need to set up your account and get started with QuickBooks.

You’ll also remain on their Ledger subscription as one of the QuickBooks Online Accountant (QBOA) admin users. Ledger helps you streamline operations and increase efficiency by bringing more clients into QuickBooks Online, reducing time spent switching between accounting solutions. Integrate with the tools you already use to run your firm and manage your clients. First, you can write and print checks directly from QuickBooks to pay for expenses that require immediate payment.

Additionally, you can manage employee permissions by allowing access to specific information. The client menu lets you add new clients, edit existing clients’ details, or make a client inactive. This feature lets you create projects or tasks and assign them to your team members. One of the most useful features is the ability to create recurring projects, which makes sense as accounting professionals often manage projects that are repeated regularly. You can specify how often the project will be repeated and the end date.

- You will also learn how to apply payments received to outstanding invoices and receive partial payments from customers.

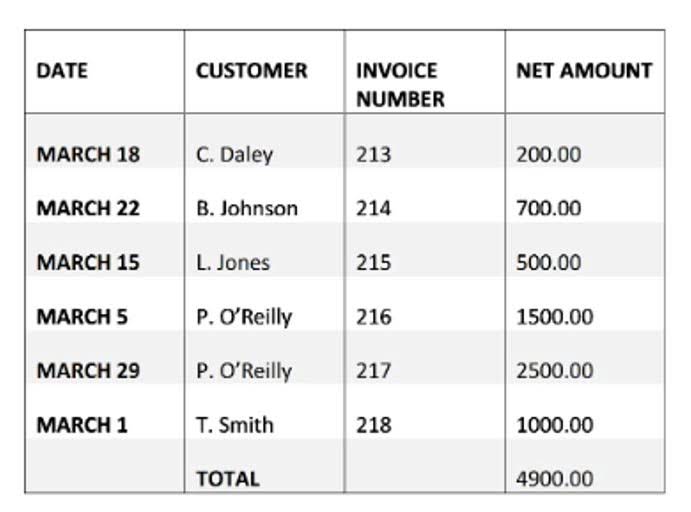

- By the end of this chapter, you will be able to keep track of your credit sales by creating and emailing invoices to your customers as well as recording cash sales where no invoice is needed.

- In adherence to the FSB editorial policy, we seize every opportunity to try the accounting practice software we review firsthand, allowing us to test how the features work in real-world scenarios.

- Feature enhancements over the last year help users save time and get the assistance they need.

- Your clients’ bank transactions flow into QuickBooks Ledger automatically, reducing manual data entry and enabling access to real–time data.

Managing Business Credit Card Transactions

In May 2002 Intuit launched QuickBooks Enterprise Solutions for medium-sized businesses. QuickBooks Online users can invite their accountant or bookkeeper to their company file. Ideally, accounting practice software providers should offer various qbo accounting ways for users to seek support, including phone and email support, self-help guides, and training opportunities. With these accountant-only tools, you can streamline your work and access customizable reports, so you can advise clients quickly.